Querying the screener with code

The screener can be queried with a mini expression language that consists of logical operators (AND, OR, NOT) and comparison operators (<, >, <=, >=, =, !=).

examples:priceToEarnings < priceToBook

get stocks where the price/earnings ratio is less than the price/book ratio

priceToEarnings < priceToBook * 12

get stocks where the price/earnings ratio is less than 12 times the price/book ratio

marketCap > 100000000000 or marketCap > 100b

stocks with a market cap greater than 100 billion

(priceToBook < 2) OR (priceToEarnings < 5)

parenthesis are optional, they can be helpful when you are unsure of the precedence of the operators.

price <= sqrt(priceToEarnings * PriceToBook *22.5)

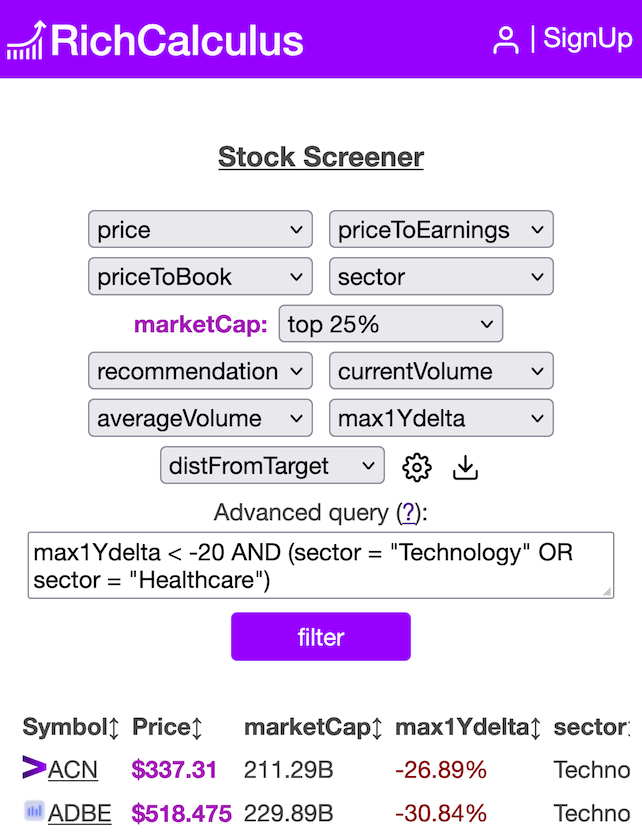

The code must be entered in the code box, and the query can be combined with basic filters:

Tech or Healthcare stocks that dipped more than 20% this year and have a market cap bigger than 75% of all other stocks

not empty

priceToEarnings < 10

this will return stocks where priceToEarnings is less than 10 or "N/A" (empty)

priceToEarnings < 10 AND NOT empty(priceToEarnings)

this gets rid of stocks where priceToEarnings is empty

Numbers

Big numbers can be abbreviated with the suffixes: "m","b","t" for million, billion, trillion.

e.g:

marketCap > 1t

Available Keys

- price

- priceToEarnings

- priceToBook

- sector

- marketCap

- recommendation

- currentVolume

- averageVolume

- max1Ydelta

- distFromTarget

- dividendYield

- 1Yhigh

- debtToEquity

- revenuePerShare

- heldPercentInsiders

- trailingEps

- changeToday

- country

- priceToTarget

- pctFloatShorted

- debt

- EBITDA

- totalCash

Available Operators

>, <, <=, >=, AND, OR, NOT, =, !=, +, -, *, /, mod, abs, sqrt, empty, avg, min, max

Aggregate functions

There are three aggregate functions (avg, min, max) and they act as expected.

marketCap > avg(marketCap)

get stocks with a marketCap greater than the average marketCap of all stocks

aggregate functions can contain a subquery: avg(KEY,SUBQUERY)

marketCap > avg(marketCap,sector="Technology")

get stocks with a marketCap greater than the average marketCap of tech stocks

You can use the special this keyword inside a subquery to refer to the current stock being filtered

marketCap > avg(marketCap,sector=this.sector)

get stocks with a marketCap greater than the average of its corresponding sector.